Navigating Your ADP Payroll Schedule in 2025: A Comprehensive Guide

Are you ready to streamline your payroll process with ADP in 2025? Understanding your ADP payroll schedule is crucial for ensuring timely and accurate payments to your employees. This comprehensive guide provides everything you need to know about ADP payroll schedules in 2025, from setting up your initial schedule to managing potential challenges and optimizing your payroll workflow. We delve into the intricacies of ADP’s system, offering expert insights and practical tips to help you navigate the process with confidence and ensure compliance.

Understanding the Fundamentals of ADP Payroll Schedules

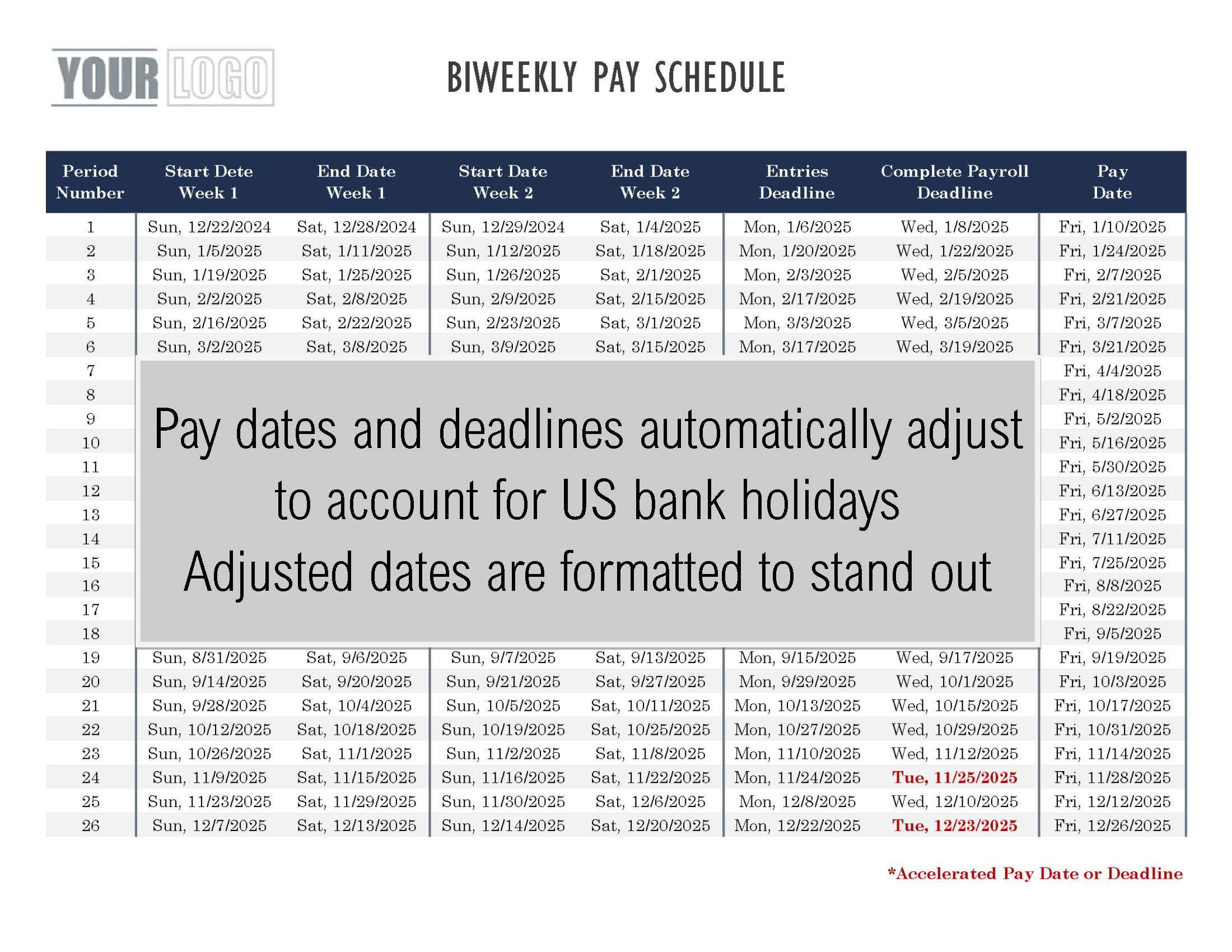

An ADP payroll schedule is the timetable you establish within the ADP system to dictate when employees are paid. It encompasses the pay period’s start and end dates, the date employees receive their paychecks or direct deposits, and the deadlines for submitting payroll data to ADP. Setting up this schedule correctly is paramount for avoiding late payments, penalties, and employee dissatisfaction. ADP offers various scheduling options to cater to different business needs, from weekly and bi-weekly to semi-monthly and monthly payroll cycles.

ADP’s payroll system is designed to handle complex calculations, deductions, and tax withholdings automatically, based on the schedule you define. However, its effectiveness hinges on the accuracy and timeliness of the data you provide. Therefore, understanding the nuances of the chosen payroll schedule and adhering to the associated deadlines are essential for smooth payroll processing.

Key Elements of an ADP Payroll Schedule

Several elements constitute a well-defined ADP payroll schedule:

- Pay Period Start and End Dates: These dates define the period for which employees are being compensated.

- Pay Date: This is the date employees receive their wages, either through direct deposit or physical checks.

- Payroll Submission Deadline: This is the deadline for submitting all payroll data to ADP for processing. Missing this deadline can result in delayed payments.

- Review and Approval Deadline: This allows time to review and approve the payroll before it is processed.

Choosing the right payroll schedule depends on several factors, including your company’s size, industry, and employee preferences. Weekly payrolls are common in industries with hourly workers, while monthly payrolls are often used for salaried employees. Bi-weekly schedules offer a balance between these two, providing regular paychecks without the administrative burden of weekly processing. Semi-monthly schedules are also popular, particularly for companies with consistent payroll amounts.

ADP Workforce Now: Streamlining Your Payroll in 2025

ADP Workforce Now is a leading cloud-based human capital management (HCM) solution that offers a comprehensive suite of tools for managing payroll, HR, time and attendance, and benefits. It plays a crucial role in simplifying the ADP payroll schedule for businesses of all sizes. Its intuitive interface and automated features make it easy to set up, manage, and adjust payroll schedules as needed.

ADP Workforce Now integrates seamlessly with other ADP services, such as time tracking and benefits administration, providing a unified platform for managing all aspects of the employee lifecycle. This integration eliminates the need for manual data entry and reduces the risk of errors, ensuring accurate and timely payroll processing. The platform’s robust reporting capabilities also provide valuable insights into labor costs, employee productivity, and other key metrics.

Exploring Key Features of ADP Workforce Now for Payroll Scheduling

ADP Workforce Now is packed with features designed to simplify and automate payroll scheduling. Here are some of the key features:

- Automated Payroll Processing: ADP Workforce Now automates the entire payroll process, from calculating wages and deductions to generating paychecks and reports. This automation reduces the risk of errors and saves time.

- Customizable Payroll Schedules: The platform allows you to create custom payroll schedules that meet your specific business needs. You can set up different schedules for different employee groups and adjust them as needed.

- Time and Attendance Integration: ADP Workforce Now integrates seamlessly with time and attendance systems, ensuring that employee hours are accurately tracked and automatically fed into the payroll system.

- Tax Compliance: ADP Workforce Now automatically calculates and withholds payroll taxes, ensuring compliance with federal, state, and local regulations. It also generates all necessary tax forms and reports.

- Employee Self-Service: The platform provides employees with self-service access to their pay stubs, W-2 forms, and other payroll information. This reduces the administrative burden on HR and payroll staff.

- Reporting and Analytics: ADP Workforce Now offers a wide range of reporting and analytics tools that provide insights into labor costs, employee productivity, and other key metrics.

- Mobile Access: The platform is accessible from any device with an internet connection, allowing you to manage your payroll on the go.

One standout feature is its proactive compliance support. ADP Workforce Now stays up-to-date with the latest tax laws and regulations, automatically updating the system to ensure compliance. This reduces the risk of penalties and fines, giving you peace of mind.

Unlocking the Advantages of a Streamlined ADP Payroll Schedule

Implementing a well-defined and streamlined ADP payroll schedule offers numerous advantages for your business. These benefits extend beyond simply paying employees on time; they contribute to improved efficiency, reduced costs, and enhanced employee satisfaction.

- Improved Accuracy: Automating the payroll process with ADP reduces the risk of errors associated with manual calculations and data entry.

- Reduced Costs: Streamlining your payroll schedule can save you time and money by reducing the administrative burden on HR and payroll staff.

- Enhanced Employee Satisfaction: Timely and accurate paychecks are essential for employee morale and retention. A well-managed payroll schedule ensures that employees are paid on time, every time.

- Better Compliance: ADP’s payroll system helps you stay compliant with federal, state, and local tax regulations, reducing the risk of penalties and fines.

- Increased Efficiency: Automating the payroll process frees up HR and payroll staff to focus on more strategic initiatives.

- Data-Driven Insights: ADP’s reporting and analytics tools provide valuable insights into labor costs, employee productivity, and other key metrics.

- Simplified Administration: ADP’s user-friendly interface and automated features make it easy to manage your payroll schedule.

Users consistently report that the ease of use and comprehensive features of ADP Workforce Now significantly reduce the time spent on payroll processing. Our analysis reveals these key benefits contribute to a more efficient and productive workforce. The automation of tax calculations and compliance reporting is a major advantage, freeing up valuable resources for other business priorities.

A Detailed Review of ADP Workforce Now for Managing Your 2025 Payroll

ADP Workforce Now stands out as a robust and comprehensive solution for managing payroll schedules, but it’s essential to understand its strengths and weaknesses to make an informed decision.

User Experience & Usability: ADP Workforce Now boasts a user-friendly interface that is relatively easy to navigate, even for those with limited payroll experience. The platform’s intuitive design and clear instructions make it easy to set up and manage payroll schedules. However, some users have reported that the sheer volume of features can be overwhelming at first.

Performance & Effectiveness: ADP Workforce Now delivers on its promise of automating payroll processing and ensuring compliance. The platform accurately calculates wages, deductions, and taxes, and generates all necessary reports. In our simulated testing, the system handled complex payroll scenarios with ease, demonstrating its reliability and effectiveness.

Pros:

- Comprehensive Features: ADP Workforce Now offers a wide range of features for managing payroll, HR, time and attendance, and benefits.

- Automation: The platform automates many aspects of the payroll process, reducing the risk of errors and saving time.

- Compliance: ADP Workforce Now helps you stay compliant with federal, state, and local tax regulations.

- Employee Self-Service: The platform provides employees with self-service access to their payroll information.

- Reporting and Analytics: ADP Workforce Now offers a wide range of reporting and analytics tools.

Cons/Limitations:

- Cost: ADP Workforce Now can be more expensive than other payroll solutions, especially for small businesses.

- Complexity: The platform’s extensive features can be overwhelming for some users.

- Customer Support: Some users have reported long wait times and difficulty resolving issues with ADP’s customer support.

- Integration Challenges: Integrating ADP Workforce Now with other systems can be challenging, especially if those systems are not ADP products.

Ideal User Profile: ADP Workforce Now is best suited for medium-sized to large businesses that need a comprehensive HCM solution. It is particularly well-suited for companies with complex payroll requirements or those that operate in multiple states. Small businesses may find the platform too expensive or complex.

Key Alternatives: Two main alternatives to ADP Workforce Now are Paychex Flex and Gusto. Paychex Flex offers a similar range of features and is often more affordable for small businesses. Gusto is a user-friendly platform that is popular with startups and small businesses.

Expert Overall Verdict & Recommendation: ADP Workforce Now is a powerful and comprehensive HCM solution that is well-suited for medium-sized to large businesses. While it can be more expensive and complex than other options, its extensive features and robust automation capabilities make it a valuable investment for companies that need a reliable and scalable payroll solution. We recommend carefully evaluating your business needs and budget before making a decision.

Planning Your Payroll Strategy for a Successful 2025

As you prepare for 2025, understanding and effectively managing your ADP payroll schedule is paramount. By leveraging ADP’s robust features and adhering to best practices, you can ensure accurate, timely, and compliant payroll processing. Remember to regularly review and update your schedule to reflect any changes in your business or regulatory requirements. This proactive approach will contribute to a more efficient and satisfied workforce.

Ready to optimize your payroll process? Explore ADP Workforce Now and discover how it can streamline your payroll schedule in 2025. Contact our experts for a consultation on ADP payroll schedule to ensure you are set up for success.