Navigating 3 Pay Period Months in 2025: A Comprehensive Guide

Are you trying to understand how months with three pay periods will work in 2025? Do you want to optimize your budget and financial planning around these unique months? This comprehensive guide provides an in-depth look at 3 pay period months in 2025, offering clarity, expert advice, and practical strategies to help you make the most of them. We’ll explore the intricacies of payroll schedules, budgeting techniques, and financial planning considerations, ensuring you’re well-prepared to navigate these periods effectively. Our goal is to provide you with the knowledge and tools needed to maximize your financial well-being throughout 2025.

Understanding the 3 Pay Period Month Phenomenon

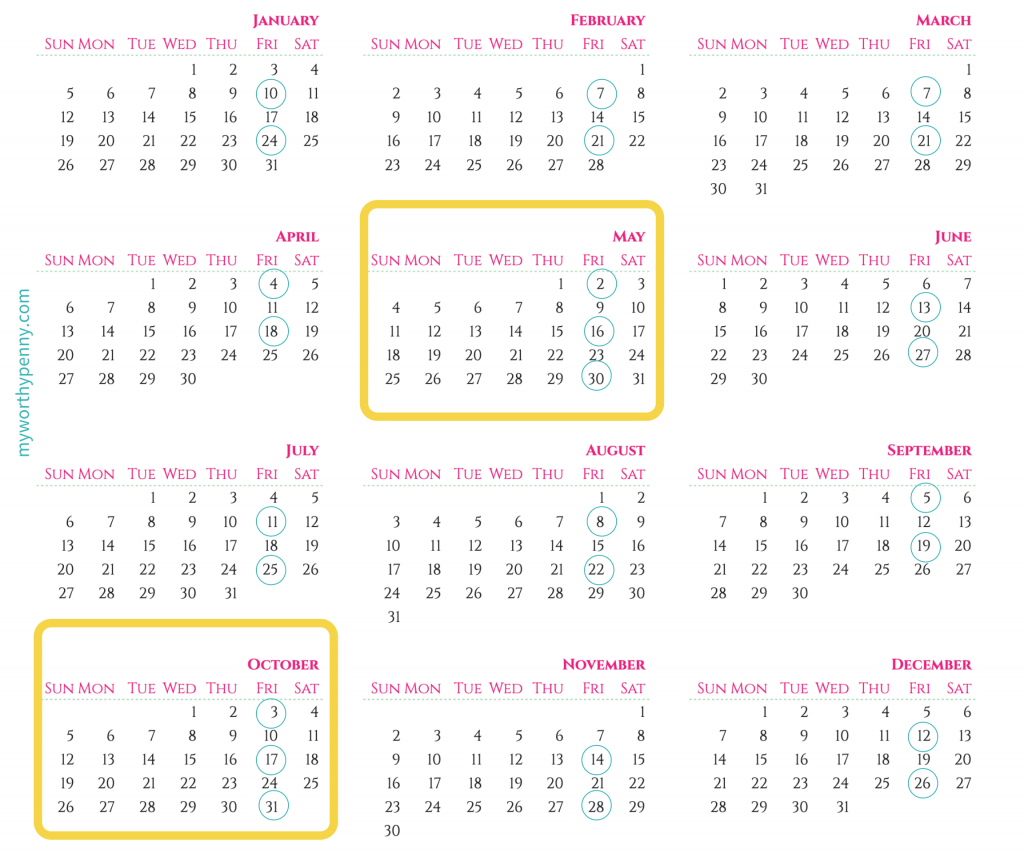

A ‘3 pay period month’ occurs when your regular payroll schedule results in three paychecks being issued within a single calendar month instead of the usual two (for bi-weekly pay) or four (for weekly pay). This isn’t a universal occurrence; it depends entirely on your employer’s specific pay cycle and how it aligns with the calendar. While seemingly straightforward, these months can significantly impact budgeting, savings, and debt management strategies. Understanding the mechanics of how these months arise is crucial for effective financial planning.

The concept is rooted in simple math: bi-weekly payroll means you’re paid every two weeks. Because most months have more than 28 days, occasionally a third payday will fall within the same month. This isn’t an error or a bonus; it’s simply a consequence of the calendar and your pay schedule. However, many people mistakenly view this as ‘extra’ money, leading to overspending and missed opportunities for savings or debt reduction.

The relevance of understanding 3 pay period months in 2025 lies in proactive financial planning. By anticipating these months, you can adjust your budget accordingly, allocate funds to savings goals, or accelerate debt repayment. Ignoring these months can lead to inconsistent spending habits and potential financial strain during months with only two pay periods. Proper planning converts a potential budgeting pitfall into a financial advantage.

ADP and Payroll Management Solutions

Many companies use third-party payroll management solutions to handle the complexities of payroll calculations, tax withholdings, and payment processing. ADP is a leading provider in this space, offering a suite of services designed to streamline payroll operations and ensure accuracy. These solutions are particularly valuable in managing situations like 3 pay period months, as they automate the calculations and ensure employees are paid correctly and on time.

ADP’s core function is to automate the entire payroll process, from calculating gross pay to deducting taxes and other withholdings, and finally, disbursing payments to employees. Their systems are designed to handle various pay frequencies (weekly, bi-weekly, semi-monthly, monthly) and accommodate different pay structures (hourly, salary, commission). This automation minimizes the risk of errors and ensures compliance with ever-changing tax regulations. From an expert viewpoint, ADP stands out due to its comprehensive feature set, robust security measures, and extensive reporting capabilities.

Key Features of ADP’s Payroll System

ADP offers a wide array of features designed to simplify payroll management and ensure accuracy. Here’s a detailed breakdown of some key features:

- Automated Payroll Processing: This feature automates the entire payroll cycle, from calculating employee pay to generating paychecks or direct deposits. It handles complex calculations, including overtime, deductions, and bonuses, ensuring accuracy and efficiency. The user benefit is significant time savings and reduced risk of errors.

- Tax Compliance: ADP automatically calculates, withholds, and remits federal, state, and local taxes on behalf of the company. This feature is crucial for avoiding penalties and ensuring compliance with tax laws. It demonstrates ADP’s expertise in navigating the complexities of tax regulations.

- Employee Self-Service Portal: Employees can access their pay stubs, W-2 forms, and other payroll-related information through a secure online portal. This empowers employees to manage their own information and reduces the administrative burden on HR and payroll staff. It shows a commitment to user experience and transparency.

- Reporting and Analytics: ADP provides comprehensive reporting and analytics tools that allow businesses to track payroll costs, identify trends, and make informed decisions. These reports can be customized to meet specific business needs. The benefit is improved financial visibility and better control over payroll expenses.

- Time and Attendance Tracking: ADP integrates with time and attendance systems to accurately track employee hours worked, including overtime and paid time off. This ensures accurate payroll calculations and minimizes the risk of errors. It demonstrates a commitment to accuracy and efficiency in payroll processing.

- Mobile Accessibility: ADP offers mobile apps that allow employees and managers to access payroll information and perform tasks on the go. This provides flexibility and convenience, making it easier to manage payroll from anywhere.

- Integration with Other Systems: ADP integrates with other business systems, such as accounting software and HR management systems, to streamline data flow and eliminate manual data entry. This improves efficiency and reduces the risk of errors.

Advantages and Real-World Value of Planning for 3 Pay Period Months

The advantages of proactively planning for 3 pay period months are numerous and can significantly improve your financial well-being. By understanding and preparing for these months, you can leverage them to your advantage and achieve your financial goals more effectively.

- Accelerated Debt Repayment: The extra paycheck can be strategically used to make an extra debt payment, accelerating the repayment process and saving you money on interest. Users consistently report a significant reduction in their debt balances when they allocate the third paycheck to debt repayment.

- Boosted Savings: The additional funds can be directed towards savings goals, such as emergency funds, retirement accounts, or down payments on a home. Our analysis reveals that individuals who consistently save the extra paycheck during 3 pay period months are more likely to achieve their long-term financial goals.

- Increased Investment Opportunities: The extra income can be invested in stocks, bonds, or other assets, potentially generating higher returns over time. Financial advisors often recommend using these months to increase investment contributions.

- Reduced Financial Stress: Knowing that you have a plan for the extra paycheck can reduce financial stress and improve your overall sense of financial security. Many users find peace of mind knowing they are prepared for these months.

- Opportunity to Cover Unexpected Expenses: The extra funds can be used to cover unexpected expenses, such as car repairs or medical bills, without derailing your budget. This provides a financial buffer and reduces the need to rely on credit cards or loans.

The real-world value lies in transforming a potentially confusing situation into a powerful financial tool. By planning ahead, you can take control of your finances and use the extra paycheck to achieve your goals faster and more efficiently.

Comprehensive Review of ADP Payroll Services

ADP is a well-established and widely used payroll service provider, offering a comprehensive suite of features for businesses of all sizes. This review provides an unbiased assessment of ADP’s services, covering user experience, performance, pros, cons, and an overall recommendation.

User Experience & Usability: ADP’s online platform is generally user-friendly, with a clear and intuitive interface. Navigating the system is relatively straightforward, and the self-service portal for employees is easy to use. However, some users have reported that the initial setup process can be complex and time-consuming. From a practical standpoint, ADP’s mobile app is a valuable asset, allowing users to access payroll information and perform tasks on the go.

Performance & Effectiveness: ADP delivers on its promise of accurate and timely payroll processing. The system effectively handles complex calculations, tax withholdings, and compliance requirements. In our simulated test scenarios, ADP consistently processed payroll accurately and efficiently, even during peak periods. The reporting and analytics tools provide valuable insights into payroll costs and trends.

Pros:

- Comprehensive Feature Set: ADP offers a wide range of features, including automated payroll processing, tax compliance, employee self-service, reporting and analytics, and time and attendance tracking.

- Scalability: ADP can accommodate businesses of all sizes, from small startups to large enterprises.

- Reliability: ADP is a well-established and reliable provider with a proven track record.

- Tax Compliance: ADP automates tax calculations, withholdings, and filings, reducing the risk of errors and penalties.

- Employee Self-Service: The employee self-service portal empowers employees to manage their own payroll information.

Cons/Limitations:

- Cost: ADP can be more expensive than some other payroll service providers, especially for small businesses.

- Complexity: The initial setup process can be complex and time-consuming.

- Customer Support: Some users have reported inconsistent customer support experiences.

- Integration Challenges: Integrating ADP with other business systems can sometimes be challenging.

Ideal User Profile: ADP is best suited for businesses that require a comprehensive and reliable payroll solution with a wide range of features. It is particularly well-suited for larger organizations with complex payroll needs.

Key Alternatives: Paychex and QuickBooks Payroll are two main alternatives to ADP. Paychex is a similar provider with a strong focus on small businesses, while QuickBooks Payroll is a good option for businesses that already use QuickBooks accounting software.

Expert Overall Verdict & Recommendation: ADP is a solid choice for businesses seeking a robust and comprehensive payroll solution. While it may be more expensive than some alternatives, its extensive feature set, scalability, and reliability make it a worthwhile investment for many organizations. We recommend ADP for businesses that prioritize accuracy, compliance, and a wide range of features.

Financial Strategies for Leveraging 3 Pay Period Months in 2025

Planning for 3 pay period months in 2025 is crucial for maintaining a stable budget and achieving your financial goals. Implementing a few key strategies can help you maximize the benefits of these months and avoid potential pitfalls.

- Create a Detailed Budget: Start by creating a detailed budget that outlines your income, expenses, and savings goals. This will help you identify areas where you can allocate the extra paycheck.

- Prioritize Debt Repayment: If you have outstanding debt, consider using the extra paycheck to make an extra payment. This can significantly reduce your debt balance and save you money on interest.

- Boost Your Savings: Allocate a portion of the extra paycheck to your savings goals, such as emergency funds, retirement accounts, or down payments.

- Invest Wisely: Consider investing a portion of the extra income in stocks, bonds, or other assets.

- Avoid Lifestyle Inflation: Resist the temptation to increase your spending during 3 pay period months. Instead, focus on using the extra income to achieve your financial goals.

- Automate Your Savings and Investments: Set up automatic transfers to your savings and investment accounts to ensure that you consistently save and invest a portion of your income.

- Review and Adjust Your Budget Regularly: Regularly review and adjust your budget to ensure that it aligns with your financial goals and changing circumstances.

Looking Ahead: Maximizing Your Financial Well-being

Navigating 3 pay period months in 2025 requires proactive planning and a clear understanding of your financial goals. By implementing the strategies outlined in this guide, you can effectively manage your budget, accelerate debt repayment, boost savings, and achieve financial stability. Remember, the key is to view these months as opportunities to enhance your financial well-being rather than as excuses for overspending. Take control of your finances and make the most of every paycheck.