Euro to Dollar Forecast 2025: Expert Analysis and Predictions

Navigating the complexities of currency exchange rates can feel like predicting the future. If you’re searching for the euro to dollar forecast 2025, you’re likely trying to make informed decisions about investments, international business, or travel. This comprehensive guide provides an in-depth analysis of factors influencing the EUR/USD exchange rate, offering expert predictions and insights to help you understand potential scenarios for 2025.

This article goes beyond simple predictions. We’ll delve into the economic forces at play, examine historical trends, and consider geopolitical influences that could shape the euro to dollar exchange rate in the coming year. You’ll gain a clearer understanding of the variables involved and the potential risks and opportunities. We aim to equip you with the knowledge to make your own informed assessments and strategies.

Understanding the Dynamics of EUR/USD Exchange Rates

The euro to dollar (EUR/USD) exchange rate represents the value of one euro in terms of U.S. dollars. It’s one of the most actively traded currency pairs globally, reflecting the economic health and policies of the Eurozone and the United States. Understanding the forces that drive this exchange rate is crucial for anyone interested in international finance, trade, or investment.

Several key factors influence the EUR/USD exchange rate:

- Interest Rate Differentials: The interest rates set by the European Central Bank (ECB) and the Federal Reserve (Fed) play a significant role. Higher interest rates in one region can attract foreign investment, increasing demand for that currency.

- Economic Growth: Relative economic growth rates between the Eurozone and the U.S. impact the exchange rate. Stronger economic growth typically leads to a stronger currency.

- Inflation: Inflation rates influence purchasing power and currency value. Higher inflation can erode a currency’s value.

- Government Debt and Fiscal Policy: Government debt levels and fiscal policies can impact investor confidence and currency valuations.

- Geopolitical Events: Political instability, trade wars, and other global events can create volatility in currency markets.

- Market Sentiment: Investor sentiment and risk appetite can also drive short-term fluctuations in the EUR/USD exchange rate.

Analyzing these factors requires a deep understanding of macroeconomic principles and the ability to interpret economic data releases from both sides of the Atlantic.

The Role of Economic Indicators in Forecasting

Economic indicators provide valuable insights into the health of an economy and can be used to forecast future exchange rate movements. Key indicators to watch include:

- GDP Growth: Gross Domestic Product (GDP) measures the total value of goods and services produced in an economy.

- Inflation Rate: The inflation rate measures the rate at which prices are rising.

- Unemployment Rate: The unemployment rate measures the percentage of the labor force that is unemployed.

- Consumer Confidence: Consumer confidence surveys measure consumer optimism about the economy.

- Purchasing Managers’ Index (PMI): PMI surveys measure the activity of purchasing managers in the manufacturing and service sectors.

- Trade Balance: The trade balance measures the difference between a country’s exports and imports.

These indicators are released regularly by government agencies and economic research institutions. Analyzing these figures and understanding their implications for the Eurozone and the U.S. is crucial for developing informed forecasts.

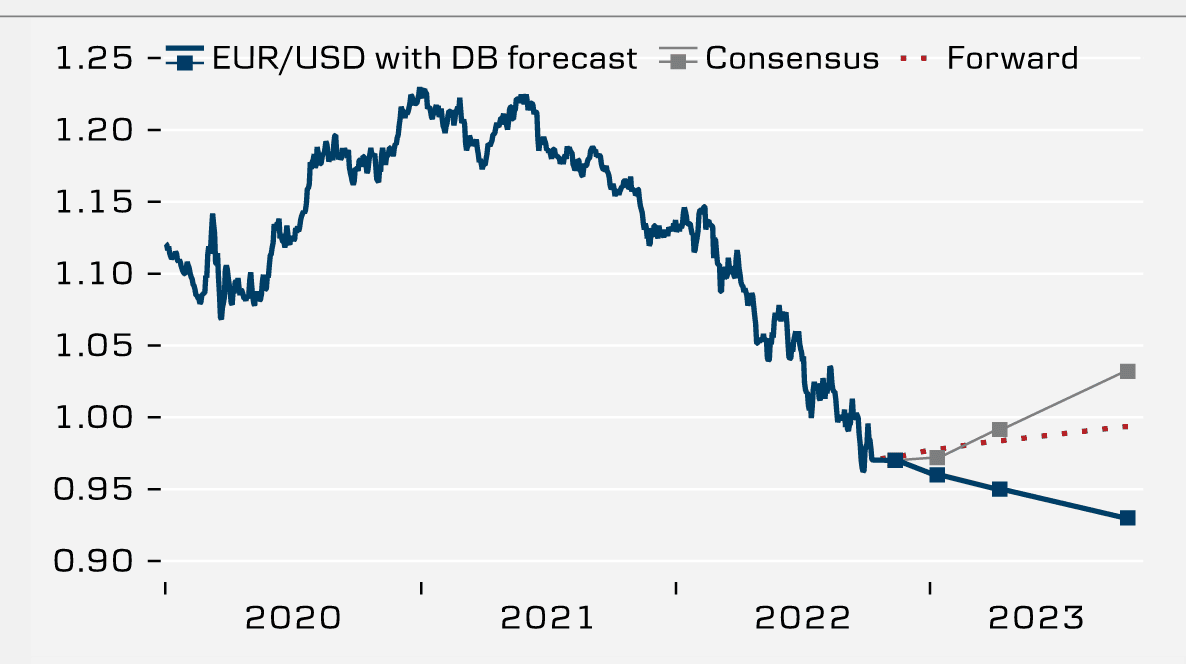

Expert Predictions for the Euro to Dollar Exchange Rate in 2025

Predicting the future of currency exchange rates is inherently uncertain, but several leading financial institutions and economic analysts offer forecasts based on their analysis of economic trends and policy outlooks. These forecasts should be viewed as potential scenarios, not guarantees.

Scenario 1: Moderate Growth in Both Eurozone and U.S.

In this scenario, both the Eurozone and the U.S. experience moderate economic growth, with inflation under control and interest rates remaining relatively stable. This could lead to a relatively stable EUR/USD exchange rate, potentially fluctuating within a range of 1.05 to 1.15.

Scenario 2: U.S. Outperforms Eurozone

If the U.S. economy outperforms the Eurozone, driven by stronger growth and higher interest rates, the dollar could strengthen against the euro. This could push the EUR/USD exchange rate down to a range of 0.95 to 1.05.

Scenario 3: Eurozone Outperforms U.S.

Conversely, if the Eurozone experiences stronger growth and the ECB raises interest rates more aggressively than the Fed, the euro could strengthen against the dollar. This could push the EUR/USD exchange rate up to a range of 1.15 to 1.25.

Scenario 4: Global Recession

A global recession could trigger a flight to safety, with investors seeking refuge in the U.S. dollar. This could lead to a significant strengthening of the dollar against the euro, potentially pushing the EUR/USD exchange rate below 0.90.

These are just a few potential scenarios, and the actual outcome could depend on a complex interplay of factors. It’s important to stay informed and monitor economic developments closely.

Factors Favoring a Stronger Euro in 2025

Several factors could potentially support a stronger euro against the dollar in 2025:

- ECB Interest Rate Hikes: If the ECB raises interest rates more aggressively than the Fed to combat inflation, this could attract foreign investment and strengthen the euro.

- Eurozone Fiscal Stimulus: A coordinated fiscal stimulus package in the Eurozone could boost economic growth and support the euro.

- Resolution of Geopolitical Risks: A reduction in geopolitical tensions, such as the war in Ukraine, could improve investor confidence in the Eurozone and strengthen the euro.

- Increased Demand for Eurozone Exports: Strong global demand for Eurozone exports could boost the region’s trade balance and support the euro.

Factors Favoring a Stronger Dollar in 2025

Conversely, several factors could support a stronger dollar against the euro in 2025:

- Fed Interest Rate Hikes: If the Fed continues to raise interest rates aggressively to combat inflation, this could attract foreign investment and strengthen the dollar.

- U.S. Economic Resilience: If the U.S. economy proves more resilient than the Eurozone in the face of global headwinds, this could support the dollar.

- Safe-Haven Demand: In times of global uncertainty, investors often flock to the U.S. dollar as a safe-haven asset.

- Strong U.S. Labor Market: A strong U.S. labor market could boost consumer spending and support economic growth, strengthening the dollar.

The Impact of Geopolitical Events on Currency Fluctuations

Geopolitical events can have a significant impact on currency markets. Events such as wars, political instability, and trade disputes can create uncertainty and volatility, leading to sharp fluctuations in exchange rates. The war in Ukraine, for example, has had a significant impact on the EUR/USD exchange rate, as investors have become more risk-averse and sought refuge in the U.S. dollar.

In 2025, potential geopolitical risks that could impact the EUR/USD exchange rate include:

- Escalation of the war in Ukraine: A further escalation of the war could lead to increased risk aversion and a stronger dollar.

- Trade tensions between the U.S. and China: A renewed escalation of trade tensions could disrupt global trade and negatively impact both the euro and the dollar.

- Political instability in Europe: Political instability in key Eurozone countries could undermine investor confidence and weaken the euro.

Monitoring geopolitical events closely is essential for understanding potential risks to the EUR/USD exchange rate.

Strategies for Managing Currency Risk

For businesses and individuals who are exposed to currency risk, there are several strategies they can use to mitigate their exposure:

- Hedging: Hedging involves using financial instruments to offset potential losses from currency fluctuations.

- Diversification: Diversifying investments across different currencies can reduce overall currency risk.

- Natural Hedge: A natural hedge is when a company’s revenues and expenses are in the same currency, which reduces its exposure to currency risk.

- Forward Contracts: Buying or selling currency at a predetermined exchange rate for a future date.

Choosing the right strategy depends on the specific circumstances and risk tolerance of the individual or business.

Understanding Currency Correlation

Currency correlation refers to the degree to which two currencies move in relation to each other. Some currencies have a positive correlation, meaning they tend to move in the same direction, while others have a negative correlation, meaning they tend to move in opposite directions. Understanding currency correlations can be helpful for managing currency risk and making informed investment decisions.

For example, the EUR/USD exchange rate often has a negative correlation with the USD/JPY exchange rate. This means that when the euro strengthens against the dollar, the dollar tends to weaken against the Japanese yen.

The Impact of Inflation on EUR/USD

Inflation plays a crucial role in determining currency values. Higher inflation in a country generally leads to a weaker currency as its purchasing power decreases. Central banks often respond to rising inflation by raising interest rates, which can attract foreign investment and strengthen the currency. The relative inflation rates between the Eurozone and the U.S. will significantly impact the EUR/USD exchange rate in 2025.

If the Eurozone experiences higher inflation than the U.S., the euro could weaken against the dollar. Conversely, if the U.S. experiences higher inflation than the Eurozone, the dollar could weaken against the euro.

The Role of Central Banks: ECB vs. Federal Reserve

The European Central Bank (ECB) and the Federal Reserve (Fed) are the central banks of the Eurozone and the United States, respectively. They play a crucial role in managing monetary policy and influencing currency values. The ECB’s primary mandate is to maintain price stability, while the Fed’s mandate is to promote maximum employment and price stability.

The ECB and the Fed use a variety of tools to achieve their objectives, including:

- Interest Rate Adjustments: Raising or lowering interest rates to influence borrowing costs and economic activity.

- Quantitative Easing (QE): Purchasing government bonds or other assets to inject liquidity into the financial system.

- Forward Guidance: Communicating their intentions to the public to influence market expectations.

The monetary policies of the ECB and the Fed will have a significant impact on the EUR/USD exchange rate in 2025. For example, if the Fed raises interest rates more aggressively than the ECB, this could attract foreign investment and strengthen the dollar.

Analyzing the Current Economic Climate

As we look towards 2025, it’s crucial to analyze the current economic climate. High inflation, rising interest rates, and geopolitical uncertainty are creating a challenging environment for businesses and investors. The Eurozone is particularly vulnerable to the impact of the war in Ukraine, as it relies heavily on Russian energy supplies. The U.S. economy, while more resilient, is also facing headwinds from high inflation and rising interest rates.

These factors suggest that the EUR/USD exchange rate could experience significant volatility in 2025. It’s important to stay informed and monitor economic developments closely to make informed decisions.

Expert Insights on Long-Term Trends

While short-term forecasts are useful for tactical decision-making, it’s also important to consider long-term trends that could influence the EUR/USD exchange rate. Some potential long-term trends include:

- The Rise of China: China’s growing economic influence could challenge the dominance of the U.S. dollar and lead to a more multipolar currency system.

- Technological Innovation: Technological innovation could boost productivity and economic growth in both the Eurozone and the U.S., potentially impacting currency values.

- Climate Change: Climate change could have significant economic consequences, impacting agricultural production, energy prices, and infrastructure.

Making Informed Decisions in a Volatile Market

Predicting the euro to dollar forecast 2025 with certainty is impossible. However, by understanding the key factors that influence the exchange rate, analyzing economic indicators, and monitoring geopolitical events, you can make more informed decisions about your investments and financial planning. Remember to consult with a qualified financial advisor before making any significant financial decisions.

Staying informed and adaptable is key to navigating the complexities of the currency market. Consider these steps:

- Regularly review economic news and forecasts from reputable sources.

- Diversify your investments to mitigate currency risk.

- Consult with a financial advisor to develop a personalized strategy.

- Stay updated on geopolitical events and their potential impact on currency markets.

Navigating the Future of EUR/USD Exchange Rates

The euro to dollar forecast 2025 remains subject to numerous unpredictable factors. By closely monitoring economic indicators, geopolitical developments, and central bank policies, investors and businesses can better prepare for potential fluctuations and manage their currency risk effectively. Understanding these dynamics is crucial for making informed financial decisions in an increasingly complex global economy. We hope this comprehensive analysis has provided valuable insights to help you navigate the future of EUR/USD exchange rates.